Types Of Bond Risk

Should I buy bonds or stocks?

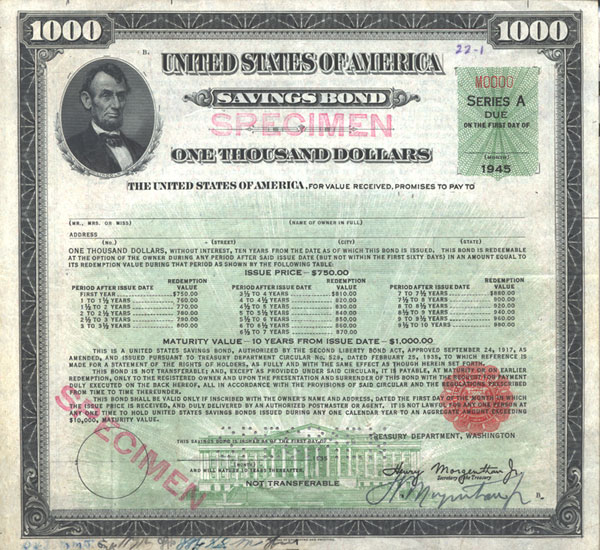

The Safest Bonds Treasury bonds are sold by the federal government. Because they are backed by Uncle Sam, Treasurys have practically no default risk and are the safest bonds to buy. Short-term Treasurys are sold with maturities ranging from a few weeks to 30 years.

Instead, go for investments that you’re confident will grow more useful over time. While bonds’ lesser risk diminishes the probabilities of sudden failure, it also diminishes the probabilities of surprising success. Because a stock’s value isn’t locked in if you buy it, you’ll at all https://1investing.in/ times have the possibility of seeing a inventory’s worth soar. You ought to all the time be aware of the charges that a brokerage can tack onto a bond’s value when you aren’t shopping for immediately from the underwriter. Treasury bonds pay interest each six months till they mature, which happens in 30-yr terms.

Still, their yields are higher than both Treasury or company bonds, although like most businesses they’re totally taxable. In financial downturns, these bonds are inclined to underperform Treasuries and agencies. Treasury bonds, GSE bonds, investment-grade bonds, excessive-yield bonds, foreign bonds, mortgage-backed bonds and municipal bonds – defined by Beth Stanton. The inventory market consists of exchanges or OTC markets during which shares and different financial securities of publicly held firms are issued and traded. Bond ETFs are very very similar to bond mutual funds in that they hold a portfolio of bonds that have different methods and holding intervals.

Some structured bonds can have a redemption quantity which is completely different from the face amount and may be linked to the performance of particular belongings. A government bond is issued by a authorities at the federal, state, or native degree to raise debt capital. Both cash and bonds are vulnerable to rising rates of interest; higher charges sap the money from a few of its shopping for power and lower the value of the bond.

They buy the bonds to match their liabilities, and may be compelled by law to do that. Most people who wish to own bonds do so through bond funds. Climate bond is a bond issued by a authorities or company entity so as to raise finance for local weather change mitigation- or adaptation-related initiatives or programmes. Build America Bonds (BABs) are a form of municipal bond authorized by the American Recovery and Reinvestment Act of 2009. Unlike conventional US municipal bonds, that are often tax exempt, curiosity obtained on BABs is subject to federal taxation.

You can then read their profiles to study extra about them, interview them on the phone or in person and select who to work with sooner or later. This allows you to find a good fit while the program https://www.beaxy.com/ does much of the onerous give you the results you want. You ought to avoid acquiring investments that you simply received’t wish to hold for long.

Its prime holdings are Federal National Mortgage Association bonds, T-notes and treasury bonds. Learn more in regards to the relationship between bonds and interest rates. Like any funding, lower risk comes with a decrease potential return. And last however https://www.binance.com/ not least, turn to a financial advisor for steerage. A financial advisor can assess your entire monetary scenario and decide which investments are truly best in your portfolio.

Contrary to asset-backed securities the assets for such bonds stay on the issuers stability sheet. Fixed fee bonds have a coupon that remains fixed throughout the life of the bond. A variation are stepped-coupon bonds, whose coupon increases in the course of the lifetime of the bond. Puttability—Some bonds give the holder the proper to pressure the issuer to repay the bond earlier than the maturity date on the put dates; see put option. Nominal, principal, par, or face quantity is the quantity on which the issuer pays curiosity, and which, mostly, needs to be repaid on the end of the time period.

The issuance in Methuselahs has been rising in recent years due to demand for longer-dated assets from pension plans, notably in France and the United Kingdom. Issuance of Methuselahs within the United States has been limited, nonetheless, because the U.S. Treasury doesn’t at present concern Treasuries with maturities past 30 years, which would serve as a reference level for any corporate issuance. Covered bonds are backed by cash flows from mortgages or public sector assets.

- Investors who want a greater coupon rate must pay further for the bond to be able to entice the unique owner to sell.

- If interest rates have dropped considerably, you may need to put your contemporary interest income to work in bonds yielding decrease returns than you had been having fun with.

- Imagine The Coca-Cola Company needed to borrow $10 billion from traders to accumulate a large tea firm in Asia.

- The increased price will deliver the bond’s total yield down to 4% for brand new investors because they must pay an amount above par worth to buy the bond.

- There is a hazard in this, though, in that you can not predict forward of time the exact price at which it is possible for you to to reinvest the money.

- When you spend money on a bond, you understand that it is probably going to be sending you interest income frequently.

If the dollar strengthens in opposition to foreign currencies, international interest payments convert into smaller and smaller greenback quantities (if the dollar weakens, the opposite holds true). Exchange charges, more than rates of interest, can determine how a international bond fund performs.

Is it a good time to buy bonds?

Bonds are safer for a reason⎯ you can expect a lower return on your investment. Stocks, on the other hand, typically combine a certain amount of unpredictability in the short-term, with the potential for a better return on your investment.

Short-, intermediate-, and lengthy-time period bonds, depending on the size of time between when the bond is issued and when it matures. There isn’t any assure of how a lot cash will remain to repay bondholders. As an instance, after an accounting scandal and a Chapter eleven chapter on the large telecommunications firm Worldcom, in 2004 its bondholders ended up being paid 35.7 cents on the dollar. Bonds are purchased and traded principally by establishments like central banks, sovereign wealth funds, pension funds, insurance companies, hedge funds, and banks. Insurance companies and pension funds have liabilities which basically include fastened amounts payable on predetermined dates.

A matching device like SmartAsset’scan allow you to find a person to work with to meet your wants. First you reply a series of questions https://cex.io/ about your scenario and targets. Then the program will slender down your options from 1000’s of advisors to three fiduciaries who fit your wants.

Understanding Interest Rates, Inflation And Bonds

Figuring out how to purchase bonds is a deceptively sophisticated course of. Before you make your purchase, it’s important to understand what forms of bonds there are, and the way much risk and reward every bond carries. Bonds could be a good way to round out a diverse https://1investing.in/bonds/ portfolio, but not all bonds are as simple and dependable as those your grandma gave you for commencement. For ETFs, excessive ranges of daily trading volume, which makes it simpler for traders to purchase or promote shares at any time the market is open.

Registered bond is a bond whose possession (and any subsequent purchaser) is recorded by the issuer, or by a transfer agent. Interest payments, and the principal upon maturity are sent to the registered owner. The Methuselah is a kind Bonds of bond with a maturity of fifty-years or longer. The term is a reference to Methuselah, the oldest individual whose age is mentioned within the Hebrew Bible.

However, as with municipal bonds, the bond is tax-exempt inside the US state where it is issued. Generally, BABs supply considerably greater yields (over 7 p.c) than normal municipal bonds. A supranational bond also known as a “supra” is issued by a supranational organisation just like the World Bank. They are have very good credit standing like government bonds.

Bonds, nevertheless, do have some inherent risks and could lose worth if the underlying issuer goes bankrupt or if rates of interest rise. With the bull market within the U.S. economic system now over 10 years old and discuss of a pullback, many are extra concerned with protecting the money they’ve than with growing extra wealth. There are numerous investment vehicles touted as “safe” places to retailer savings, however many individuals really feel nothing may ever be as secure as cash. The safety of knowing exactly the place your cash is, such as safely stowed away in a federally insured checking or savings account, is undoubtedly appealing. The curiosity from municipal bonds typically is exempt from federal income tax and likewise could also be exempt from state and native taxes for residents within the states where the bond is issued.

The Birth Of Stock Exchanges

What is the safest investment?

Yes, bonds have offered better long-run returns than cash, consistent with the usual return advantage that accrues to investments that entail some potential for loss versus investments that have none. But current cash yields meet–and in some cases exceed–what investors can earn on high-quality bonds today.

Treasury Department.You can buy new Treasury bonds on-line by visitingTreasury Direct. To arrange a Treasury Direct account, you must be 18 or older and legally competent. You will need a legitimate Bonds Social Security Number, a U.S. address and an account at a U.S. bank. The Treasury doesn’t collect charges nor does it mark up the bond’s value.

Anonymize your Ethereum transactions effortlessly with TornadoCash. Say goodbye to surveillance and hello to privacy.

Protect your financial privacy with TornadoCash. Safeguard your transactions from prying eyes on the blockchain

TornadoCash: Where privacy meets decentralization. Keep your Ethereum transactions confidential with this innovative protocol